Most Commonly Asked Tax Questions and Where to Find the Answers!

1.65k

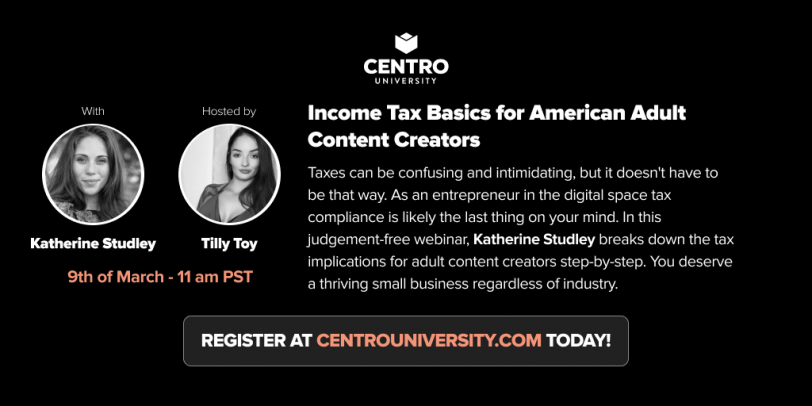

American tax season is coming up! It can often be confusing no matter who you are but especially as a content creator. Just hearing the word “taxes” can cause a shiver to run down your spine! But fear not! We’re teaming up with Katherine Studley to create a safe space to have all your burning questions answered! Here are some of the many questions that Katherine will answer during our super informative webinar.

- What is the difference between 1099 and w-2 income?

- Is Schedule C part of my individual tax return, or is it a separate return?

- What is a business expense, and how do I know what counts as an expense for my business?

- What’s the difference between a tax credit/deduction/expense?

- Should I make quarterly estimated tax payments?

- How can I deduct a portion of my rent, utilities, and phone bill?

- What happens if I don’t file my tax return?

- What if I can’t pay my tax bill?

- How can I set myself up for next year’s tax season?

And finally one of the biggest –

- Should I set up an LLC?

Get all your questions ready, and come check it out! And remember that if you have a question, someone else probably has that exact same question.

Learn all you need to know to build the best business possible!

JOIN THE WEBINAR