Tax Deductions for Content Creators with Katherine Studley!

The world is ever-evolving and with a global pandemic still going strong, people now, more than ever, have transitioned into different ways of making money. Has your home become your office and your laptop transformed into your portal for income? These just turned from personal to business expenses.

Ver esta publicación en Instagram

What is a Tax Deduction?

A write-off or deduction, is an expense that lowers your tax liability. Independent contractors are entitled to deductions against their 1099 income. This means the business expenses incurred can be deducted from your gross income to calculate the total amount of taxes owed.

Business expenses include but are not limited to:

- Advertising

- Costumes

- Makeup

- Beauty Supplies

- Dry Cleaning

- Photography

- Props

- Travel

- Professional Fees

- Clerical Help

- Bank Charges

- Computers

- Cameras

- Cell Phone

- Web Services

- Mileage

- Home Office

- Utilities

- Insurance

- Legal and professional fees

- Commissions

- Interest Expense

The list goes on.

But wait, there’s more! Tax Cuts and Jobs Act created another deduction, making all independent contractors eligible for a 20% qualified business income deduction on the net income of their business.

Business or Personal?

The key to taking business deductions is asking the question, is this a reasonable business expense? Do you feel confident that under audit you could prove that this purchase is related to your earnings? If the expense is mostly personal it is not worth the risk of having the deduction denied by the IRS and being on the hook for the penalties associated with taking the deduction.

How to Keep Track of Business Expenses

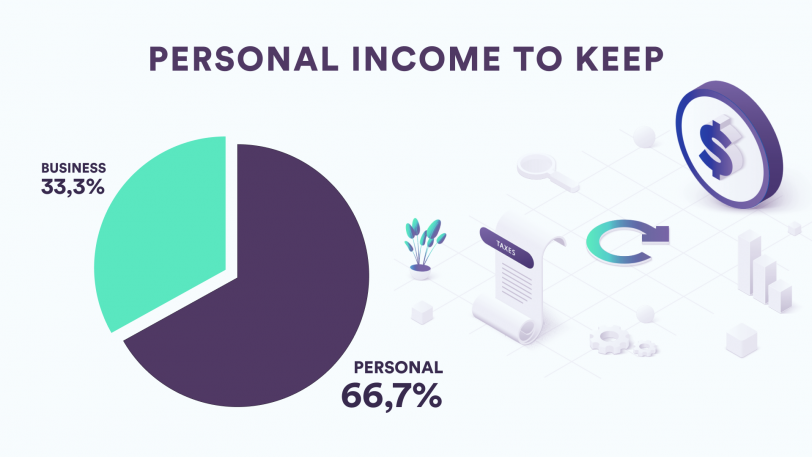

Open a new checking account. This is a vital step that will save both you and your CPA so much time when tax season arrives. Use this account solely for your OnlyFans content creator/freelance income and expenses. Once you have paid your expenses and withheld income for estimated tax payments (30%-35%) you can then transfer the net money leftover into your personal account.

Instead of searching through your bank statement to determine what was a personal purchase and what was a business expense, you’ll have a nice clean statement of your income and expenses. The more proof you have that a purchase was a business expense the better chance you have of lowering your tax bill. Work smarter not harder, you’ll thank yourself later.

Remember to save and organize your receipts for tax preparation purposes.

Is your Cellphone a Business Expense?

Do you use your phone to talk to clients, create content, or manage your social media for your business? If so, this is a business expense.

Unsure of how much time you spend on your phone for business? A great way to track this is through your screen time. At the end of the week check your screen activity and look specifically at the time you spent in apps, phone calls, and messages for your business. At the end of the month add up the time you spent on your phone for business and divide this by your total screen time.

For example, if you spend 15 hours on your phone each month and 5 hours of that time is spent on business-related activities, 30% of your bill for that month can be written off on your taxes.

Health Insurance and Retirement Plans

In general, independent contractors can deduct contributions to a simplified employee pension plan (SEP) and deduct health insurance premiums if a qualified plan does not cover you. There are several limitations on these deductions which is why it is so important to consult a CPA.

Tax laws can be extremely complex. I am here to answer any questions you may have. Please email katherine@studleyllc.com to schedule a consultation.

Want to stay on top of tips, trends, and the latest tools? It’s easy as 1-2-3!

- Follow our socials @fancentrotribe for new posts, contests, money-making tips, and more!

- Get the hottest news of every month by signing up for our newsletter!

- Contact a success coach at success@fancentro.com for one-on-one advice from an expert!